How to Find Investors for Your Startup: Strategies and Tips

Finding investors for a startup is almost always an inevitable step. Small companies often lack the necessary funds and can’t develop without external support. Funding from investors can boost a new business and implement their nonstandard ideas in life.

Let’s discuss where to find investors for a startup and how to approach them.

What investors look for in a startup

By knowing what investors value, you can understand what arguments to use when communicating with them. Here are the three things they pay attention to:

- Scalability. Businesses with the potential to develop greatly attract the attention of investors. Investors appreciate a scalable company strategy, a sizable target market, and a readily expandable product or service, as well as a clear route to scaling up. Entrepreneurs must show how they intend to expand their consumer base and boost income without going over budget.

- Strong team. Just as crucial as the concept itself are the individuals driving the startup. Teams with appropriate experience and a diversity of talents are what investors look for.

- Market fit and traction. Investors want proof that there is a big market for the startup’s products or services. Sales data, market research, and customer reviews may all be used to illustrate this. Growing user bases, recurring income, and collaborations are some of the early signals of traction that point to a successful company.

What should you start with to get funding?

Analyze your business

Before seeking funding, critically evaluate your business. Are there gaps in your business model, product, or team? Do you need to refine your value proposition or improve your market strategy? Make sure your startup is as professional and appealing as possible and that your business strategy is sound. Your company may even need to shift course or undergo some adjustments to attract investments — be ready for it.

Understand what investors suit you

source: staging-appinventiv.kinsta.cloud

Accurately gauging your current growth stage is crucial for selecting the right investors. Each stage of a startup’s development is suited to different types of funding.

| Stage | Focus | Funding options |

| Pre-seed stage | Getting the business off the ground, creating a minimum-viable product | Personal funds, benefactors, bootstrapping, crowdfunding, occasionally angel investors, and rarely dedicated venture capital funds |

| Seed stage | Validating the product, and gaining market traction | Bootstrapping, crowdfunding, angel investors, and venture capital (with a well-defined product roadmap and clear growth strategy) |

| Early stage | Scaling operations, proving the concept, and growing the customer base | Venture capital, debt financing, and possibly revenue-based financing |

| Growth stage | Rapid growth and expansion, leading up to an IPO or other major exit strategy | Venture capital (less relevant as equity becomes limited), revenue-based financing, and debt financing |

| Late stage | Preparing for exit (IPO, acquisition) | Non-dilutive funding (revenue-based financing, debt funding), occasionally VC or angel investors, for closing temporary cash flow gaps |

Prepare your speech draft

When you approach investors, having a well-prepared pitch is crucial. The structure is as follows:

- Introduction. Briefly introduce yourself and your team.

- Problem statement. Explain what pain points your startup solves.

- Solution. Explain your product or service and how it addresses the problem.

- Market opportunity. Provide data on market size and growth potential.

- Business model. Describe how your startup makes money.

- Traction. Share metrics, milestones, and any evidence of demand or success.

- Competitive landscape. Highlight your competitive advantage and how you stand out.

- Financial projections. Offer realistic and well-researched financial forecasts.

- Funding request. Specify how much funding you need and how you will spend it.

- Closing. Express hope to continue the discussion.

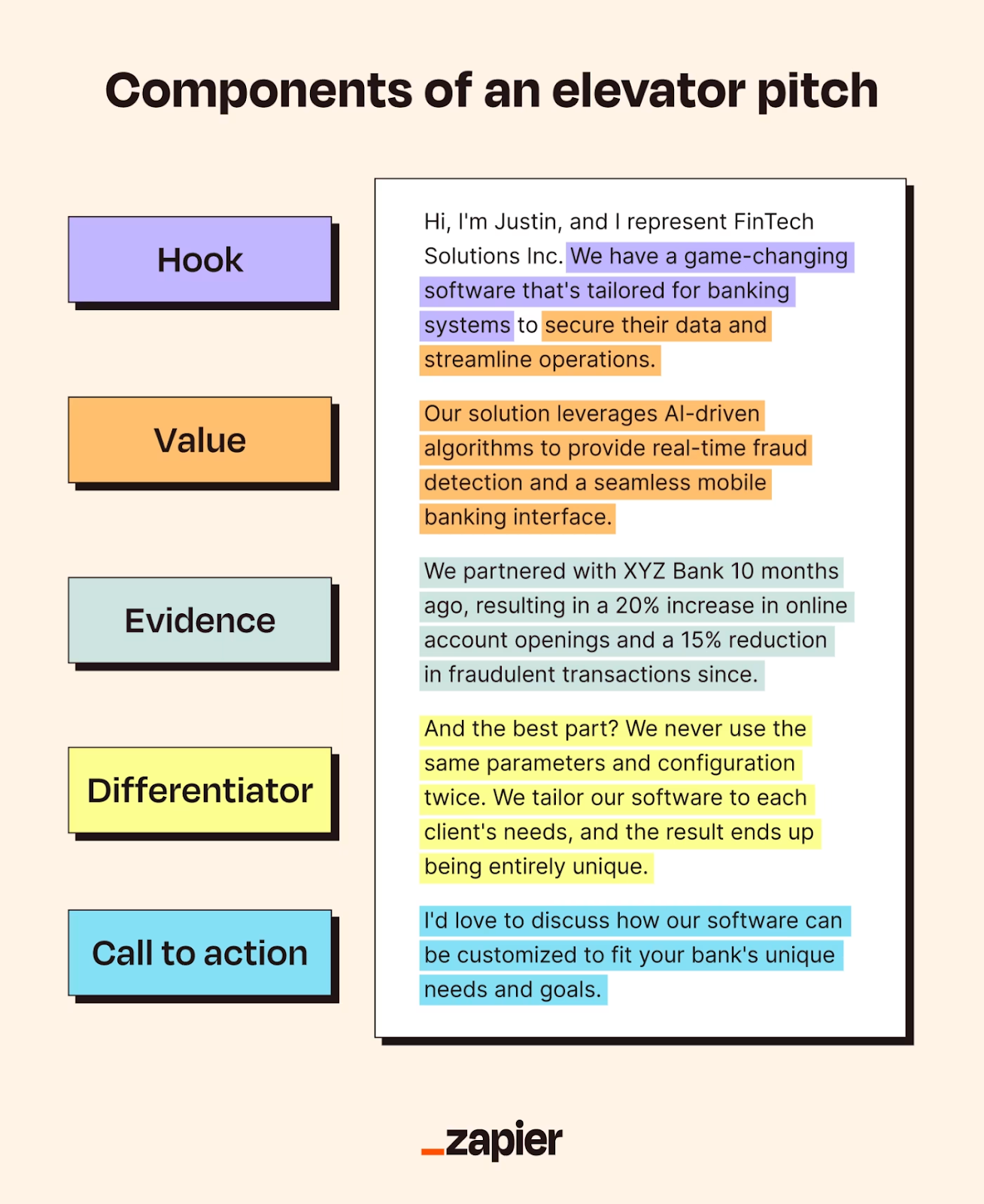

The average length of such a pitch is about a minute. Here is an example of a speech for an investor:

source: zapier.com

Take part in offline meetings

Offline meetings are a great way to meet possible investors. Attend pitch contests, networking events for investors, and corporate get-togethers.

Also, the partnership with startup incubators and accelerators will serve as a quality mark for your business, hinting that you are reliable and that your idea is worth investing in.

Use online platforms

Internet resources are often cheaper and more flexible than traditional methods of communication with investors. Though they may lack face-to-face interactions, online platforms are ideal for startups seeking to reach a broader audience or attract foreign investors.

The most popular online platforms for startup funding include:

- AngelList

- Crunchbase

- Kickstarter

- Crowdcube

Mistakes when seeking investment

- Lack of preparation. Going into meetings without thorough preparation can be detrimental. Know your numbers, market, and prepare your pitch minutely – there will be no other chance to make a first impression.

- Overvaluing your startup. Investors will not believe that you’ll become a unicorn startup in a year, so don’t bother them with unrealistic valuations. Be sincere about your company’s worth and back it up with data.

- Not understanding your market. A lack of market knowledge can be a deal-breaker. Conduct thorough research and demonstrate your understanding. Also, the study will demonstrate if it even makes sense to apply for funding or whether you should change the target market to one that is bigger and more prospective.

- Focusing only on money. Investors are searching for visionary founders who are driven by passion. Show your commitment and enthusiasm for the goal of your business by putting less emphasis on the financial side of things.

- Hitting the panic button when rejected. Be prepared for rejections and don’t let a “no” from investors crush your business plans. By the way, investors who turn you down can often provide recommendations to others who might be interested in your idea.

Be noticeable in investor circles, prepare your business to seek funding, and don’t take on failures. Break a leg!